Articles

RX – Still a Gem, Just in the Wrong Hands

A couple of days ago headlines read, "Dutch company VNU, Inc (VNUVY) announced they would buy IMS Health (RX) for $6.9 billion". However, in its press release, RX announced that it is merging with VNU. Did VNU buy RX or was it a merger?

Why I am still in love with Abbott

Abbott Labs got a less than happy round of applause Wednesday from the market even as it beat the consensus earnings number by a penny.

China Speed – Running into the Great Wall?

According to the Economist, the Chinese economy grew 9.4% in the first quarter in 2005 with industrial production being up an astounding 16%. Surprisingly most of that growth was real, as inflation was only 1.8%. It is impossible to say how accurate these numbers are, since they are put out by a very political and secretive entity - the Chinese government.

Beware the boredom of the bear market

In the last century, every prolonged bull market, which ran about 16 years, was followed by a similar length bear market. I believe this is not a random pattern. It takes a long time for an emotional cycle to reach its climax, and it takes a similar time to reverse that cycle and drive valuations to the other extreme. In a bull market rising prices intensify optimism and euphoria. The more persistent the ascent the more certain investors become of their abilities. As the perception of risk gets duller, even the most risk averse become risk seekers.

Demoting General Motors

Excellent article on General Motors (GM) in the May 9th edition of Business Week. Here are some important points and my thoughts.

The Good, The Bad, and The Ugly: Cendant

Today I discuss Cendant (CD), a company in the real estate and the travel industry, and their recent financial performance.

The Good, The Bad, and The Ugly – US Bank

This is what I want to see from a bank in our portfolios: growing assets - a source of loans, growing checking accounts - a source of free (cheap) funds, growth of fees - provides stable income, which is not sensitive to interest rate volatility.

The Good, The Bad, and The Ugly – AJ Galagher

As "the Ugly" and "the Bad" dominated the performance for Arthur J Gallagher & Co (AJG) this quarter, at least on the surface, and as such we will address them first.

Don’t compromise in investment dating game

For a company to find a place in our clients' portfolios it has to have three crucial ingredients: growth, quality and value. Not compromising, and thus avoiding marginal investments, is a true test of discipline - I would opt to hold cash over a marginal stock any time.

The Good, The Bad, and The Ugly: Kimberly Clark

Kimberly Clark (KMB) had a very positive development. However, it will take time before price increases will trickle down to KMB's bottom line, as inventory has to be worked out and contracts have to be re-written.

Abbott – Gotta Love It!

The only pharmaceutical company that we hold company wide is Abbott Labs (ABT). It has all the characteristics of the major pharmaceutical company: very strong balance sheet, great cash flows, nice fat profit margins and return on capital to die for.

Few accept slower growth gracefully

At some point even the most successful company will reach a size at which a supernormal growth rate is not possible. The law of large numbers is as inevitable as gravity, setting in slowly but surely.

Introduction to Minyanville

With this article Minyanville is proud to welcome Vitaliy Katsenelson to the 'Ville. Mr. Katsenelson holds a CFA and has worked in the asset management industry since 1995.

Bitter pill for pharmaceutical companies

In the good old days, pharmaceutical companies traded at a significant premium to the market, which was justified by predictable earnings growth, bulletproof balance sheets, Microsoft-monopoly-like profit margins and a return on investment that was the envy of corporate America. Those good old days are gone.

Future Looks Bright for Computer Associates

I'm satisfied with Computer Associates' performance in the latest quarter, plus, its organic growth numbers look good. I love companies with recurring revenues, Computer Associates has an attractive valuation, an improved corporate and financial profile - and, likely, a brighter future.

Ukraine Developments Are a Positive Sign

I would like to politely disagree with Jeff Matthews and politely agree with Geoff Johnson on the political situation in Ukraine. Though I am sometimes mistaken for an expert on Russia, I am not one.

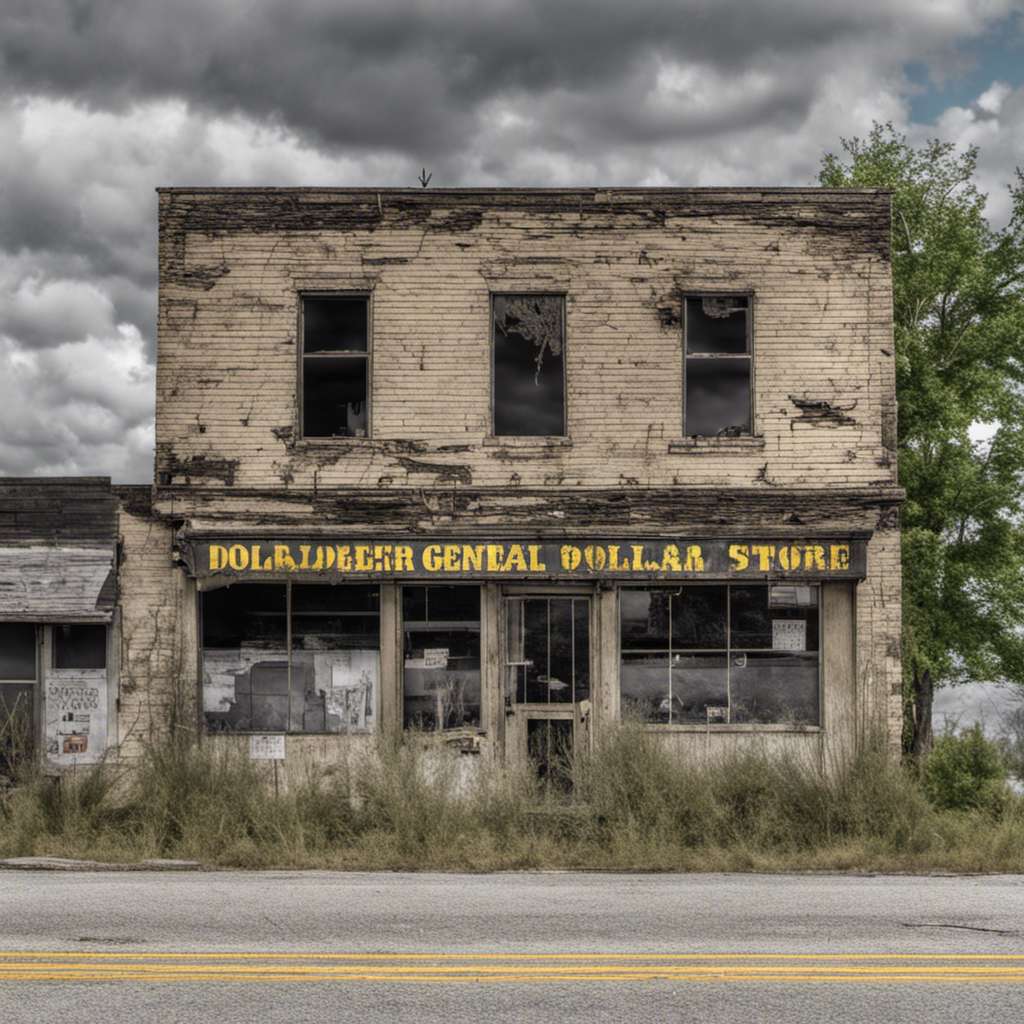

Dollar General Fails to Show Me the Dollar

Last quarter I truly hoped that things could not get any worse for Dollar General (DG), but they did. I was a big believer in a Dollar General turnaround, but I think I was wrong.

Higher Rates Are a Clear and Present Danger to Economy

Consumers have carried the U.S. economy on their backs for a long time, but lately they are showing signs of fatigue. Consumers' response to higher food prices shows how frail they really are.

IMS Health: A Dusty Gem

IMS Health (IMS) is one such gem. On the surface, its financials look very rocky. Its sales and net income have not grown much over the years.

Becton Dickinson Finds ‘Sweet Spot’ Pharmas Have Missed

November 5, 2004 – TheStreet.com: Street Insight Predictability of revenue and earnings along with a likely dividend increase make BDX ...

Sara Lee Struggling to Pass on Higher Commodity Prices

October 27, 2004 – TheStreet.com: Street Insight Premium consumer brands no longer guarantee pricing power. Sara Lee (SLE) reported earnings ...