Articles

Putin: The Mask is Off. Europe is Next.

When Putin started the war, he tried to shift the blame to NATO, calling it the instigator. He argued that Russia had no choice but to defensively launch the war to prevent NATO from surrounding Russia from all sides. A few days ago, Putin finally lifted his veil of pretense: this is a war of conquest.

ARKK Stocks Sunk

The better ARK performed, the more money flowed into its main ETF, ARKK. It used this money to buy more sci-fi ARKK stocks, pushing up the prices of its holdings. This created a vicious cycle that has now reversed.

Sitting on the Tarmac in The Land of Stoicism

I recently took Jonah and Hannah to NYC for a long weekend. Jonah was leaving for Israel that Sunday and Hannah and I decided to join him for the weekend to inhale the art and culture that New York has to offer. However, this trip to NYC started with me practicing a bit of Stoicism.

Why Is Inflation So High Right Now? 6 Reasons + What Happens Next

The war in Ukraine will likely pour more gasoline on the already raging inflationary fire, threatening to send the global economy into stagflation. Stagflation is a slowdown of economic activity caused by inflation.

A Value Investor Gathering in Omaha

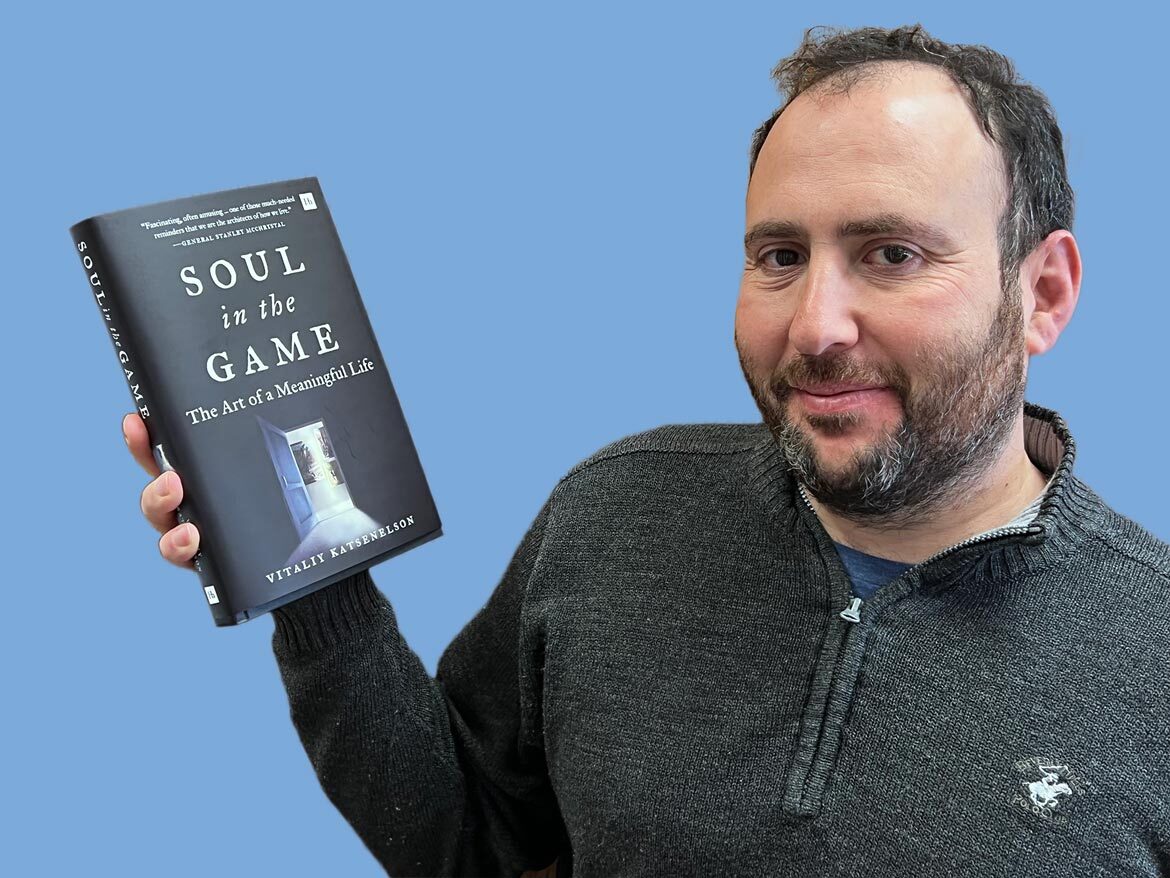

I am hosting an intimate gathering for friends, readers, and fellow value investors from 8–10:30 AM on Friday, April 29, 2022, at Lula B’s in Omaha. Stop by and enjoy some delicious breakfast. If you show up early enough, you might even get a free signed copy of my new book, Soul in the Game: The Art of a Meaningful Life.

Turning a PBS Interviewer into Interviewee

I was interviewed on PBS Newshour about the insanity that is happening in the NFT market. I can sum up my thoughts in one sentence: NFTs, just like cryptocurrencies, are not just a technology of the future, but a speculative bubble induced by excess global liquidity in the present.

Mental Models for Investing – an Interview with The Value Perspective

I sat down with the Value Perspective podcast to discuss my value investing approach. Much of the conversation ended up focusing on mental models and frameworks that I’ve found useful in analyzing businesses - and the market as a whole - as a value investor. You can read the transcript or listen to the original podcast interview below.

Soul in the Game – The Art of a Meaningful Life

This is my newest book. It has nothing to do with investing. In fact, it is a deeply personal collection of inspiring stories and hard-won lessons that weave together insights from classical composers, ancient Stoics, and contemporary thinkers. It's a tapestry of practical wisdom that has helped me overcome some of my greatest challenges - in work, family, identity, and health.

War in Ukraine: Part 4 – Are There Neo-Nazis in Ukraine?

In his speech declaring war on Ukraine, the dictator of Russia, Vladimir Putin, said the goal of his “special operation” was the de-Nazification of Ukraine and ridding it of drug addicts. He’d remove the democratically elected government and install a Russia-friendly puppet government instead, thus expanding the power and influence of the Russian empire. But are there neo-Nazis in Ukraine?

War in Ukraine: Part 3 – The Future of Russia

Sanctions have a checkered history. They didn’t get rid of Castro in Cuba or the Kims in North Korea. It took more than a decade for sanctions against South Africa in the 1980s to bear fruit. But the world has never seen sanctions like this. Ironically, these sanctions may give Putin even more power.

War in Ukraine: Part 2 – The New World

Just as 9/11 dramatically changed the flow of history, resulting in two wars and hundreds of thousands of deaths and millions of lives ruined, so too will Putin’s invasion of Ukraine. Right now, we are seeing only the first effects and getting glimpses of second-order effects. The broad third-order effects will not be visible for a long time, though they’ll be obvious in hindsight.

War in Ukraine: Why I Was Blindsided, Part 1

Eight days before Russia invaded Ukraine, I wrote an article saying there would be no war. I was certain of it. I was wrong. Why I was blindsided? The more you knew about the situation, the more likely you were to get it wrong.

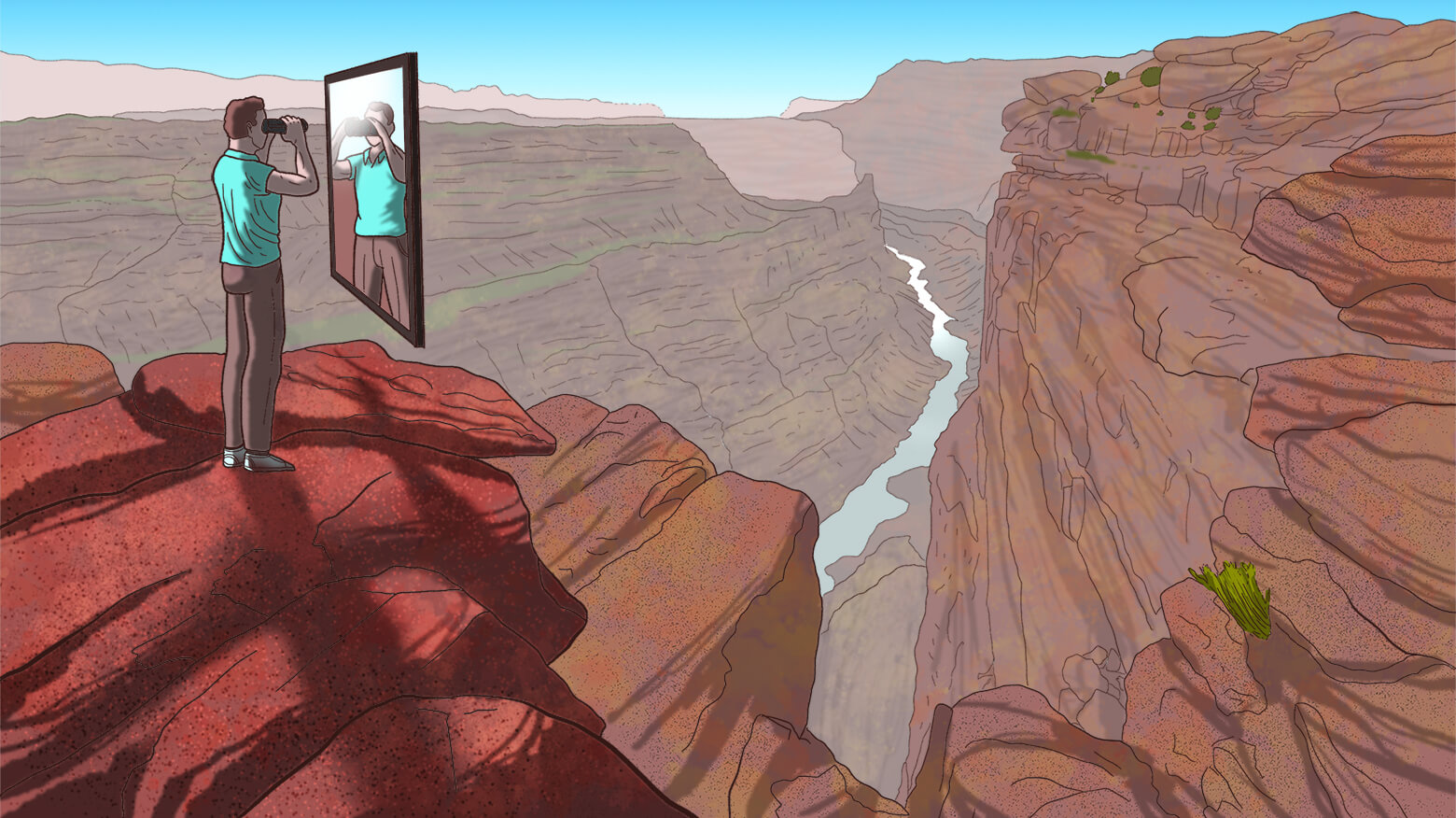

See More Clearly With These Two Mental Models

I'm a big fan of mental models. They allow you to think through analogy, often folding complex concepts into simple ones and transporting them from one discipline to another. They're thinking shortcuts. If you arm yourself with mental models, you’ll often see what others don’t.

COVID, Inflation, and Value Investing: Answers to “Millenial Investing”

I was recently interviewed by Millennial Investors podcast. They sent me questions ahead of time that they wanted to ask me “on the air”. I found some of the questions very interesting and wanted to explore deeper. This article is that exploration.

Not So Quiet on the Eastern European Front

To understand the situation, we have to at least attempt to understand the Russian perspective. After the collapse of the Soviet Union, the US and Western allies made a promise to Russia that NATO would not expand its membership to countries that had borders with Russia. In the US we are spoiled by our geography; we feel secure. Russia sees Ukraine joining NATO as a clear and present danger to its national security.

How to Build a Portfolio for Today’s Crazy Markets

We don’t know what the stock market will do next. We have opinions and hunches, and we never act on them. We never try to predict the market’s next move. Neither we nor anyone else is good at it. The only thing we can do is to trim the sails of our portfolio to align with the winds of inflation.

Position Sizing: How to Construct Portfolios That Protect You

Some investors think the fewer positions you own, the cooler you are. I remember meeting two investors at a conference. One had a seven-stock portfolio, the other had three stocks. Sadly, the financial crisis humbled both. On the other hand, too many positions breeds indifference. At IMA, our portfolio construction process is built from a first-principles perspective.

Why Green Energy is a Luxury Belief – But Won’t Be One Forever

Being a rich country has allowed us to develop what some call “luxury beliefs” – ideas that make us feel good but that fail upon contact with objective reality. We ignore inconvenient truths about green energy and keep marching on, trying to convert an even larger portion of our economy to wind and solar, without contemplating the related costs. When it comes to electricity generation, luxury beliefs can be dangerous.

McKesson: Why the Best is Yet to Come

What we have today in MCK is the largest drug distributor in the US, with a very stable and growing business. It is very cash-generative, doesn’t need much capital to grow, and has a very high return on capital. Owning the stock was very stressful at times but also very rewarding. But the best is yet to come for MCK.

I Kid You Not Crazy

It seems that every year I think we have finally reached the peak of crazy, only to be proven wrong the next year. The stock market and thus index funds, just like real estate, have only gone one way – up. Index funds became the blunt instrument of choice in an always-rising market. But you don’t have to be a stock market junkie to notice the pervasive feeling of euphoria.

How to Invest When There’s Nowhere to Hide

I was having lunch with a close friend of mine. He mentioned that he had accumulated a significant sum of money and did not know what to do with it. It was sitting in bonds, and inflation was eating its purchasing power at a very rapid rate.