Articles

30 Years in America

On the 30th Anniversary of my family's arrival in the United States from Soviet Russia, I reflect on my time here. After recounting the hard early days in a new country when I was "fresh off the boat", I offer perspective on how America has changed since I arrived. What I see now is, in some ways, more troubling than what I found all those years ago as a new immigrant.

This Holiday, Will Mr. Market Eat Too Much Pi?

There happens to be a cryptocurrency, one of thousands, that is also named Omicron. I still cannot grasp the logic behind it, but that cryptocurrency was up 900% on the day the South African variant was christened. There must have been a trading algorithm or a lot of bored investors looking for the next gamble, to drive something seemingly worthless up 900%.

Inflation Update: Not Transitory Yet!

Today we are experiencing a perfect storm of inflation. A perfect storm is formed by seemingly small factors. Each one on its own may not be particularly significant, but once combined they result in an event that significantly exceeds the sum of all parts. I provide an update on my previous two inflation articles, and the risks I see on the horizon in the next few quarters.

Inflation Update: Not Transitory Yet!

Today we are experiencing a perfect storm of inflation. A perfect storm is formed by seemingly small factors. Each one on its own may not be particularly significant, but once combined they result in an event that significantly exceeds the sum of all parts. I provide an update on my previous two inflation articles, and the risks I see on the horizon in the next few quarters.

Beloved Country. Unloved Hedge. (Updated)

My thinking on gold, the US Dollar, our national debt and our reserve currency status has not really changed much since August 2020, except that at IMA we have been increasing our exposure to foreign companies whose business is not tied to the US. We still have a small hedge in gold – I am as unexcited about it as I was when I wrote this article.

Our Analysis of UBER (Updated)

I re-share and update my analysis of Uber, and why it remains an attractive investment. I provide a mental model of how to analyze companies that may appear expensive but have yet to reach escape velocity in their cost structure and have a large market addressable market that they’ll likely dominate.

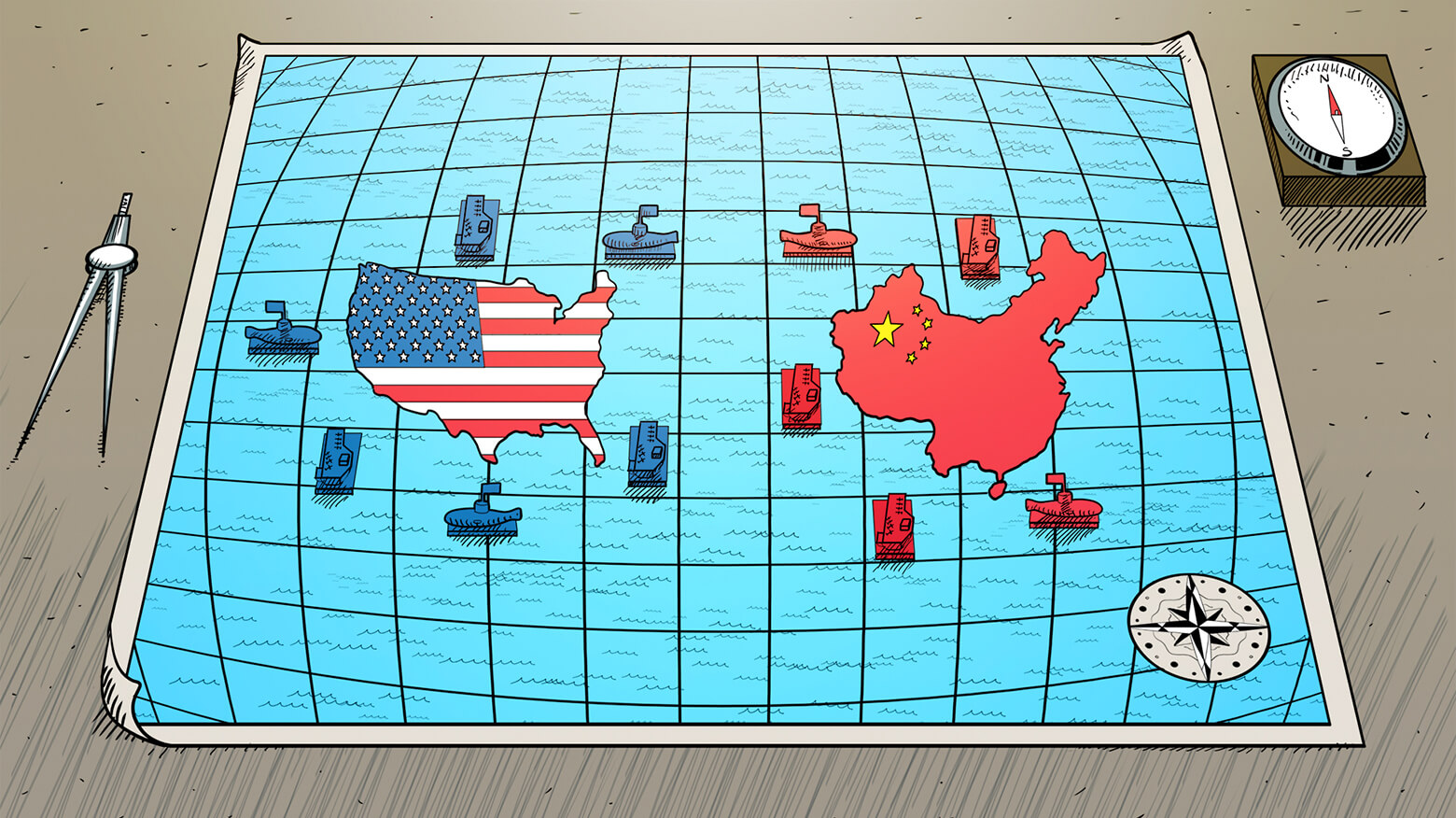

US and China: In the Foothills of Cold War (Updated)

In this article, I update my views about the US and China, and include my original article going over the risks posed by tensions between the two nations. I also discuss and share an update on IMA's investment in defense stocks, in light of the current geopolitical climate.

Let’s Keep Humans At The Heart Of Hiring Practices

The Financial Times recently published an article about my travails in recruiting. After sharing the article, I expand on what I learned about recruiting, teams, and culture since becoming CEO of IMA.

Winning the Ovarian Lottery

“At least a billion people on earth at this moment who would consider their prayers answered if they could trade places with you.” – Sam Harris

The Softer Side of Value Investing

Culture matters. I share how I evolved from an analyst purely focused on numbers to an investor and CEO focused on people. Using two stories from IMA's own past, I recount how running the business made me a better investor.

Rooting For The Underdog

For the longest time, my son Jonah would beat his younger sister Hannah at just about everything. That all changed when we watched The Queen's Gambit earlier this year.

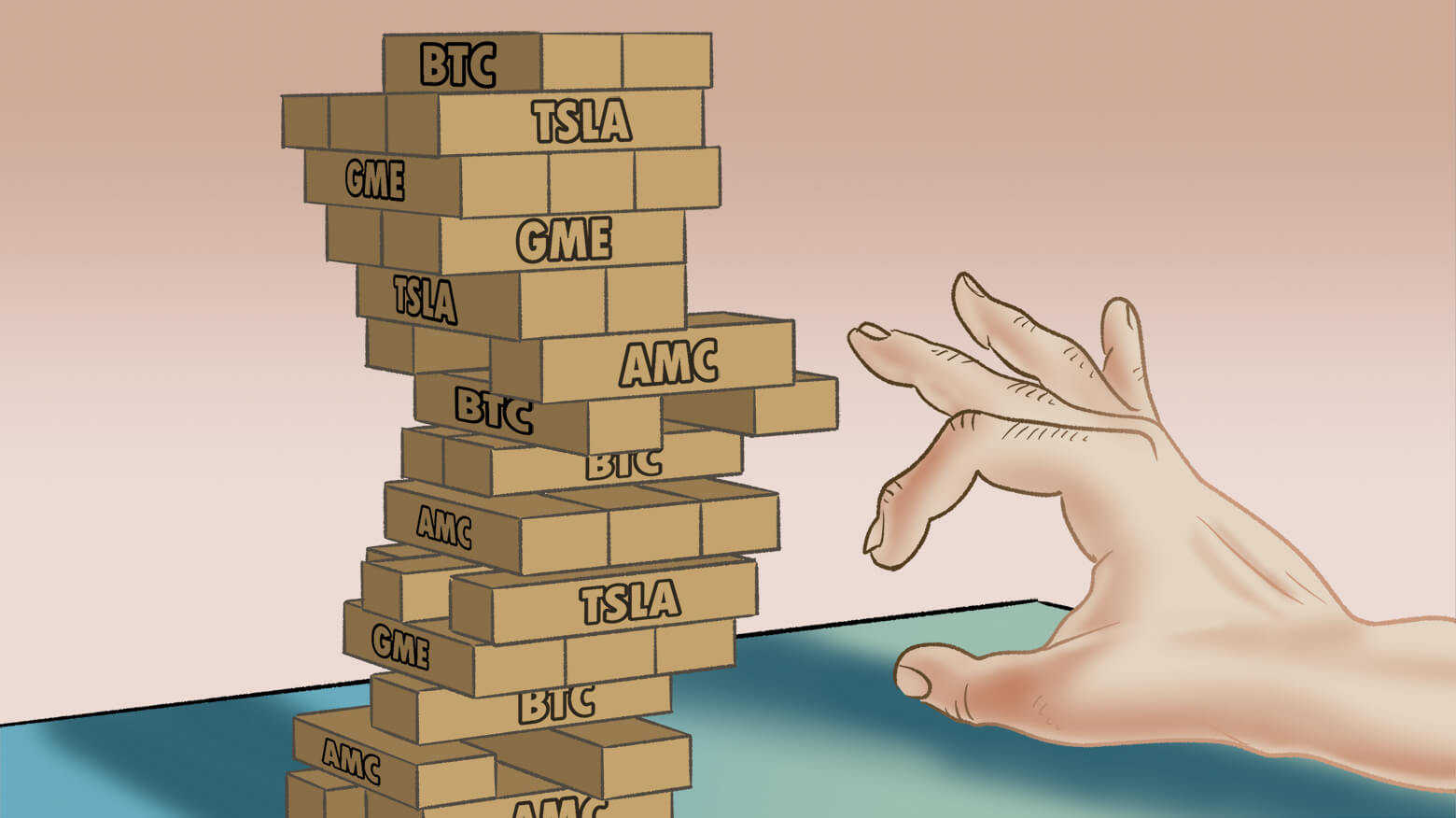

Fool’s Gambit

In investing, there are many "games to play". There are a lot of ways to try to make money in the market, and not all of them are good, rational, or productive over the long term.

Unconditional Love

I recount the first time I felt fear. Not the fear of losing my own life, but the fear a parent feels when their kids are at risk. I remember this harrowing episode, and what it taught me about being a parent.

Sideways Market

I go over why we may be entering a sideways market (I wrote two books on this subject), as well as how to invest in them.

How To Invest In Inflation

Finding investments to weather the storm. Strategies and ways to mitigate inflation risk, including investing in businesses with pricing power, capital intensity, and investing abroad.

Inflation is here. But for how long?

Exploring the nuances of inflation, including when it may be coming, from where it might arrive, and how long it might be staying.

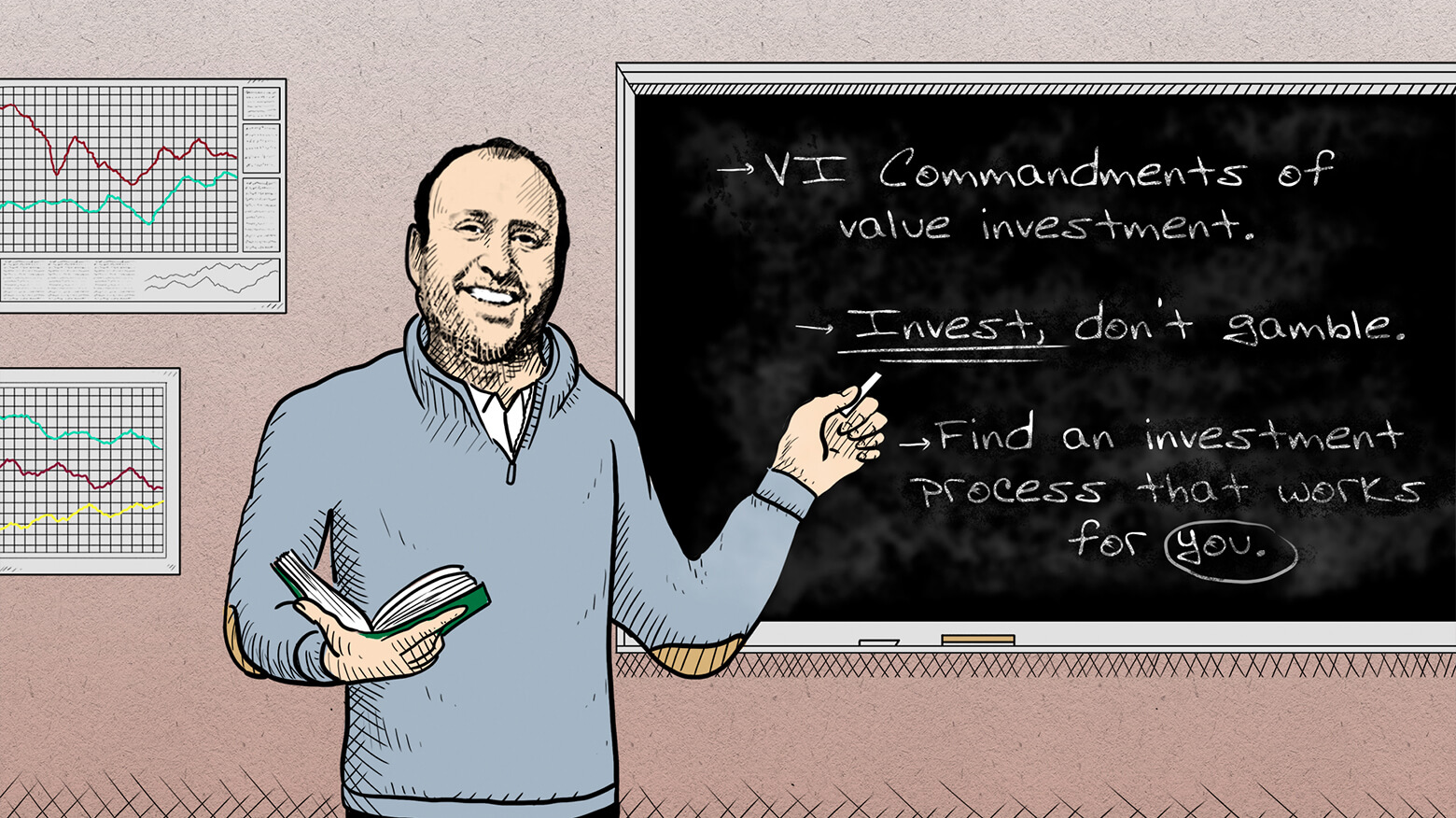

Interview with Indiana University Students

In this interview with Indiana University MBA and MsF students, I take a deep dive into my approach to investing.

My Interview with World Class Performer

In early 2021, I was interviewed by the website WorldClassPerformer.com. What follows are a series of questions about my background, influences and habits.

Go Ahead, Covet Your Neighbor’s Wife.

I recently asked another value investor if he wanted Warren Buffett's success. While this may seem like a rhetorical question, the truth is many value investors are quietly envious of Buffett.

Our Sell Discipline

How our selling practice differs between high-growth companies with long runways for compounding and slow-growth companies.

The Renaissance of Pipelines

At first, investors loved them. Then, they hated them. Now, investors have left them for dead. Oil and gas pipeline companies are anything but popular. But they are essential businesses, with rising free cash flow and substantial dividend yields.